A 2015 Organization for Economic Co-operation and Development (OECD) survey measured financial literacy (including knowledge, attitudes, and behaviors) and ranked Canadians’ overall financial literacy in 3rd out of 29 countries.

However, the same survey found that only 61% of Canadians, roughly the OECD average, correctly answered 5 out of 7 questions about financial literacy. The results show knowledge gaps in finances between different groups within Canada even though we ranked highly worldwide.

Fast forward to the most recent report shows that Canadians are taking steps to take control of their finances through budgeting, planning, and saving for the future, and

paying off debt.

However, there are also emerging signs of financial stress for some Canadians. For example, about one-third feel like they have too much debt, and a growing number are

having trouble making bills, rent/mortgage, and other payments on time.

It is my goal and passion that more Canadians become more financially knowledgeable and get compounding interest to work for them!

Let me start with a story that gives an idea of why you should be paying more attention

to compound interest.

In the second edition book of Nick Louth entitled Multiply Your Money, the author dived in right away to make his readers acknowledge the power of compound interest

through an ancient Chinese legend.

It was about a Chinese beggar inventing a new game, which was called chess. It became very famous and made the emperor want to learn it. He taught the emperor the rules of the game, and the emperor had fallen in love with the game. The emperor asked the Chinese beggar what he wanted as a reward for teaching him the game. The beggar wanted just one grain of rice on the first square. Two grains of rice on the second square. Four grains of rice on the third square and so on. Doubling each time, until all the squares on the board were filled. He also said that he will pick up his rewards on a

daily basis.

The emperor laughed and readily agreed. He thought what a fool the beggar was that

he only needed a few handfuls of rice for such a great service?

Every day, the beggar returned to the palace, and his children mocked him as he showed them the few grains of rice in his palm. By the end of the first week, he had brought a teaspoon with him. A week later, his rice had filled a wooden box. And a week later, he was wrestling with a yoke on his shoulders, from the ends of which were hung

groaning baskets of rice.

The children became silent, as were the emperor’s advisors, except for the frantic cracking of their abacus. It was only when the shouting at the palace gates announced the arrival of the first mule caravans that the emperor realized the beggar had made him lose his empire. All the rice from all the fields and barns across China wouldn’t be enough for the last square. And so the beggar became the wealthiest person in the

world.

The narration above resonates when Albert Einstein famously stated, “Compound interest is the eighth wonder of the world. He who understands it earns it. He who

doesn’t pay it.”

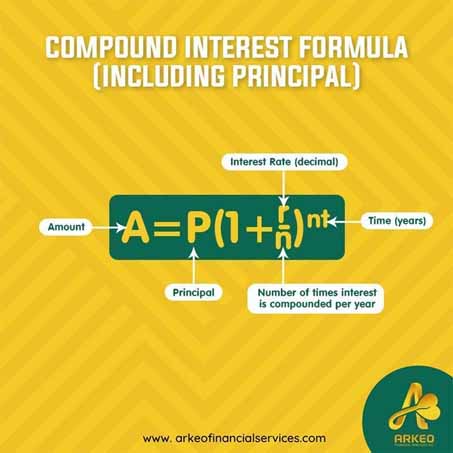

You probably heard of compound interest in your economics class or at your bank. It is widely known, but most of the time, you only have scratched the surface of the said topic. Compound interest increases the rate at which your interest earnings grow. Since interest is added to the balance, you have a larger balance and earn more interest, but

when you borrow, say with a credit card, the opposite is true.

On either side of the equation, you should be aware that compound interest is a double-edged sword. Therefore, it is an extremely effective tool for accumulating

wealth. It is also a destructive tool capable of destroying wealth.

Below is an illustration to help you visualize the concept of compounding interest.

How Compound Interest Affect your Debt

On average daily balances, many credit cards accrue interest every day. Are you aware that paying the bare minimum with your credit cards will be costly? It will hardly leave a

dent in your interest charges, and your bankroll could rise.

The average credit card interest rate as of August 18, 2021, is 16.22% APR. If you owe $5,000 in credit card debt and make only the 5% minimum payment due, you would have $68 of interest added to your balance so you would now owe the card company $4,818. This is called bad debt. Debt that further puts you in a hole and does nothing to

help increase your net worth.

Good debt on the other hand is money owed, that can help build wealth or increase

income such as leveraging good debt for investments and businesses.

Pay off bad debts quickly, and pay extra when you can. For example, with student loans, even if you are not required to pay, you will benefit by minimizing your lifetime interest expense.

How Compound Interest Affect your Savings and Investment

When you are increasing your savings, time is your friend. The longer you can keep your money intact, the more it can grow because compound interest increases the money

exponentially over time.

For example, If you deposit $150 per month at 5% interest, compounded monthly for five years, you’ll have saved $9,000 in deposits and earned $1200.91 in interest. Even if you never make another deposit after that time, after five years, your account would have earned an additional $2,890.52 in interest — much more than your initial $9,000 in deposits.

Nowadays, where can you find a vehicle that can reach 5% interest or more consistently

and without any losses? If you want to learn how let us know.

There are 3 mainstream types of vehicles that can do compound interest.

- Saving accounts – banks lend out the cash that is put into savings accounts and pay you interest for not withdrawing the fund. Interest on these accounts are

typically below 1% and barely give you anything.

- Money Market accounts – similar to savings accounts except that money market enables you to write checks and make ATM withdrawals. It has the same

the drawback of very low interest.

- Dividend stocks – stocks that pay dividends generate compound interest if you reinvest the dividends. This could be a great way to get compound interest at a higher rate. However you are at the risk of the markets, you can lose a portion or all of your capital/principal. Also dividend yields are not guaranteed and can be removed or decreased if the company hits a downturn.

Now all these three have advantages and disadvantages, however, what if there is a product that can have a decent rate and also be guaranteed compounding?

If you want to learn more, set a meeting with us so you can benefit from what works

best with your financial reality.

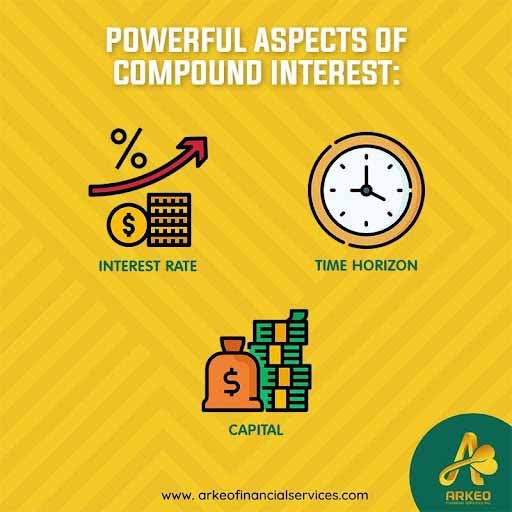

Powerful Aspects of Compound Interest

Now if you have a powerful force of compound interest working for you, you need to account for the three main factors that will affect your overall earnings: your rate, your

starting point (capital) and your endpoint (time horizon).

Your rate – Interest Rate

A higher interest rate means that more interest is added in each cycle. As a rule of thumb, anything that is above the long-term inflation rate used in economics is decent (ie. 5% or higher) especially when you have compounding working in your favor.

Your starting point – Capital

The larger amount you start with, the bigger the amount to be earned through compound interest. I highly recommend that you start with the largest amount you can if you can get decent and consistent growth.

Your end point – Time Horizon

As a rule of thumb, the higher the number of interest periods, the higher the compound interest. The longer cash compounds, the quicker it grows. The money, growing 6 percent a year, will double in about 12 years but be worth four times as much in 24 years. If you are compounding, you want your money to grow uninterrupted through the

longest possible time.

Summary

Canadians are ahead of most of the world in terms of financial literacy. However, like the beggar who invented the game of chess, we want compound interest to work for us.

By taking advantage of compound interest, you can position yourself to accumulate savings over time. And stay clear of debts and loans that may put your finances in

jeopardy.

To make an informed decision that will benefit your finances, you would need an

an experienced coach who specializes in this kind of investment vehicle.

We at Arkeo Finances and Services can help you form a personalized and detailed

blueprint to get you started multiplying your wealth.

Let me conclude with the famous quote, “The best time to start was yesterday. The next

best time is now.”

https://money.usnews.com/money/blogs/my-money/2012/09/20/10-things-you-need-to-know-about-compound-interest

https://www.forbes.com/advisor/investing/compound-interest/

https://www.thedollarstretcher.com/personal-finance/things-to-know-about-compound-interest/

https://nzcubaywide.co.nz/invest-and-save/savings-accounts/what-is-compound-interest/

https://hillnotes.ca/2019/05/09/the-state-of-financial-literacy-in-canada-how-much-do-we-know/

https://www.canada.ca/en/financial-consumer-agency/programs/research/canadian-financial-capability-survey-2019.html

https://www.debt.org/advice/compoud-interest-how-it-works/

https://www.centralbank.net/learning-center/what-is-compound-interest-and-why-its-important/

https://www.creditcards.com/credit-card-news/rate-report/

https://www.thebalance.com/compound-interest-4061154

Louth, N.(2001). Multiply Your Money. McGraw-Hill