We can’t have everything we want, or can we?

Opportunity Cost

Humans have unlimited wants. And there is also the idea of scarcity in resources in whatever form they may be. Because people must make choices, they must inevitably make trade-offs in which they must give up something they want in order to get something they want more.

Everyone wants to make decisions that maximize their happiness. Everyone is motivated by their own “self-interest.” We probably will understand it better if we equate opportunity cost with sacrifice. We might not notice it or give it a full thought at all times but in choosing an option, we always lose other options. Though it may sound like a loss, it helps us understand the limited choices we have and choose the one that will greatly offer the best result. It also helps in setting our priority list.

Before we get our priority list right we have considered our options. The opportunity cost of acquiring something is measured in terms of the sacrifice of the next best alternative. Economists often make use of the concept of opportunity cost to illustrate the basic idea of choice.

Not all costs are monetary in nature. But most are.

Opportunity costs are typically expressed as the amount of another good, service, or activity that must be sacrificed in order to pursue or produce another activity or good.

How do we calculate Opportunity Cost

We can simply use this formula

RESULT OF OPTION A

– RESULT TO OPTION B

________________________

OPPORTUNITY COST

Although the formula is simple, it can be difficult to determine the variable by factors that cannot be converted into values, such as risk, time, skills, or effort.

Three important opportunity cost factors

1. Time. Time is a commodity too. In the area of opportunity cost, time can be even more valuable than cash. Therefore, always think about the time required when making an important life decision.

2. Money. The monetary value invested in an opportunity must offer an adequate return.

3. Effort. For example, if you choose to start your own business instead of climbing the corporate ladder, the extra hassle of starting and starting a new business should be a priority. If you decide to stay on the path of the company, then the additional troubles that may lead to a successful startup may be a missed option.

Analyzing Choices

Let’s try making choices given the situation: You wish to travel. You have to decide which month to go.

In April: the plane ticket costs $1200 but the weather is better In September: the plane ticket costs $700 but the weather sucks.

Which month will you choose?

Understanding Trade-offs

Trade-offs are all the alternatives that we give up whenever we choose one course of options over others.

Example:

Choosing a smartphone with a better camera or bigger storage.

Those two features of phones are considered to be important features of a smartphone. When you’re down to choosing which brand or variation to get you may gain your most preferred feature but lose an equally important feature. We will be in a situation where choices can be both great. While in some cases we will be faced with a dilemma.

Opportunity Cost and YOU

In between great choices or dilemmas, it is necessary to choose the most suitable opportunity according to the person’s requirements, priorities, and preferences.

Are you aware that you finance everything you purchase?

Whether you go into debt and pay your bank an interest OR

You choose to save and use that money and lose the interest that money could otherwise earn (opportunity cost).

In any financial decision you make, there are costs associated with it (whether real monetary costs or opportunity costs)

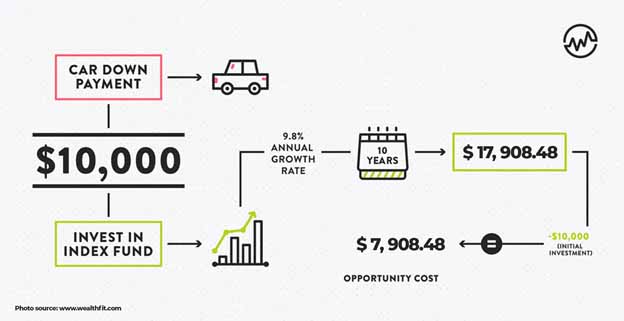

Imagine you have $10,000. There is a car you’ve been planning to own for months. At the same time, you know it is wise to invest this in something that generates 6% annually. But you can only choose one option or the other. Is it going to be the car or investment?

If you chose the car, you will be ecstatic in acquiring a car you always want to have but you lose on what that $10,000 could have generated for you. It would be losing $7,908.48 in 10 years!

Furthermore, how many cars do you buy in your lifetime? In a span of 40 years or so, how much opportunity costs are YOU missing out on? That is over $100,000 lost opportunity!

If you trade-in your car for newer models every 5 years, what would be the opportunity cost for you?

If you chose to invest it, then you would be out of a car and the comfort and convenience in travel it can give you. You also lose the time it can save you. And many other non-monetary benefits can give you.

BUT WHAT IF YOU CAN CHOOSE BOTH?

What if we can reclaim our opportunity costs?

What if we can HAVE the car AND the returns on investment?

And definitely yes, there is a way to reclaim opportunity cost! By using a specific and custom-designed asset class, to finance and leverage a lifetime of purchases, YOU can effectively reclaim your opportunity costs on any and all purchases. This process warrants a coach to ensure that it is done properly.

To find out more, please book a time with one of our coaches.