Online shopping has become everyone’s guilty pleasure at this time. And in return, we’ve had a good laugh at online shopping failures some customers have experienced. The pictures used by online shops were deceptive. Marketing strategies can go this low for any product.

Financial products are not immune to deception. Therefore, I highly encourage people to learn more about finances and their options to make an informed decision. Some terms may be introduced to you and will mostly be hyped up because it makes a particular financial product more alluring. There are times that they overemphasize the advantages and downplay the disadvantages. One of the biggest terms in any investment product is the average rate of return and Real rate of return.

You have to be aware of how these two terms should be used. Let us start by learning more about these terms and their supposed role in your decision-making. You will get the hard facts and hard evidence to form your own opinion.

What is the Average Rate of Return?

The average return is the average annual cash flow generated over the life of an investment. This interest rate is calculated by adding all expected cash flows and dividing by the number of years the investment is expected to last.

Real estate investments are expected to generate $ 22,000 in the first year, $ 32,000 in the second year, and $ 36,000 in the third year. The average of this amount is $ 30,000. The initial investment was $ 300,000, so the average return is 10% (calculated as the average return of $ 30,000 divided by the investment of $ 300,000).

When to Consider Average Rate of Return

If you are an investor with limited resources, you need methods to analyze and compare investment opportunities. The average return method allows investors to learn about their options before deciding to tie up money on a particular investment. This information is useful when investors need to consider the risk of investing and the total cost. One tool, almost all investors use is the Andex chart. It does have a lot of useful information. However, as you can see the average rates on it – can be misleading.

See the andex chart below:

According to data from YAHOO! Finance, here’s the actual performance of the S&P 500

Index over various dates and timeframes: *

- +19.4% gain 12/30/2016 to 12/29/2017 (12 months)

- +9.4% gain from 12/29/2017 to 10/01/2018 (9 months)

- -19.6% drop from 10/01/2018 to 12/24/2018 (about 3 months)

- +5.04% annual real rate of return from 01/01/15 to 12/31/2018 (4 years)

- +2.85% annual real rate of return from 12/31/1999 to 12/31/2018 (19 years)

* It’s important to note that these returns do not account for transaction fees, management fees, or administrative expenses.

No wonder your experience isn’t matching your expectations! From these statistics, we see that the common assumptions are incorrect. 5 – 7% gains don’t always happen. Actual performance doesn’t always rise. And a longer investment isn’t always better.

The Deception of Average Rate of Return

The average return method does not take into account investment risk. The average rate of returns can be utilized to mislead you. Investment firms typically promote average returns because they are higher than actual rates of return. This can give the impression that an investment is more profitable than it is. The main flaw in this calculation is that it ignores the time value of money. Cash flows from later periods are less valuable than cash flows from earlier periods. Also, the dips in the earlier year affect the final balance more significantly.

See the table below:

What is Real or Actual Rate of Return

The cash value of a return on an investment after taxes and inflation is the real rate of return. The real after-tax rate of return is a more accurate measure of investment earnings. It typically differs significantly from the nominal (gross) rate of return or before fees, inflation, and taxes. The simple real rates of return are calculated based on the starting value and the ending value of the account.

Please note that this real rate of return is a finally more meaningful figure. Real returns help me understand why my balance is lower than I started with, whereas average returns bear no resemblance to my reality, whatsoever.

It answers the one important question: What do I get in cash at the end of the day?

Calculating the real rate of return allows you to build an accurate risk profile and financial goals. Though the numbers you will see can be unimpressive, it’s important data to consider. This knowledge will assist you in calibrating your mindset, ensuring that you achieve your financial goals. The truth about the financial product must be presented to you no matter how disappointing they may seem. They are important variables that impact your real rate of return that are often swept under the rug and ignored. The common adage goes, “Successful investing is about managing risk, not avoiding it.”

Growing your finances doesn’t depend on firm persuasion of advertisements, speculation, and assumptions of what the investment can do for you. You can have data be presented to you by a financial advisor to help you manage the risk that benefits you the most.

You may not understand the potential risks associated with your investments if you do not understand the difference between average and actual returns. And that can be dangerous for your finances.

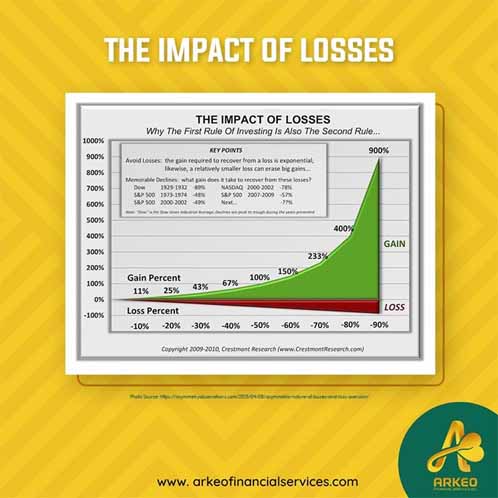

The Impact of Losses

As you can see in the example, the losses are much more powerful than the gains. Warren Buffet, one of the most successful investors in the world understands this.

With losses, average returns will always be higher than real returns.

There is so much to learn regarding the real rate of return. You can ask for more details with our very own financial experts at Arkeo Finances and Services.

What if you can grow your money without ever experiencing losses?

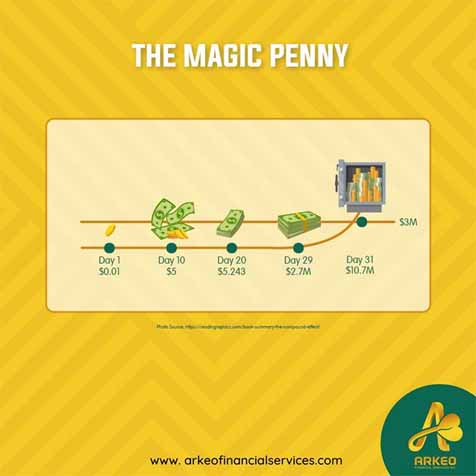

What if you start with even something as little as a penny?

In our previous article, we talked about compounding interest, what if we can combine compounding interest with no losses?

Here’s an example of compounding with no losses:

Get your list of questions ready and schedule a free consultation with us. We are bound to provide a service that could benefit your current financial status and your financial goals.

Conclusion

Now compound interest working for you is definitely a great thing! But in order to benefit greatly, you don’t want to experience losses. EVER! Because losses have a greater impact on your money!

How would you like to experience having a real rate of return that is decent?

And what if I were to tell you that it would compound without any losses whatsoever – even if the whole world is in a recession! Learn more by booking a consultation with one of our coaches.

https://www.accountingtools.com/articles/2017/5/8/average-rate-of-return

https://www.ngpf.org/blog/math/investment-math-averages-can-deceive/

https://themoneyadvantage.com/real-rate-of-return-average-is-not-rea

https://studyfinance.com/real-rate-of-return/

https://www.investopedia.com/terms/r/realrateofreturn.asp