Were you thinking of saving? Or investing?

You want to do it but don’t know where to start?

Catching the perfect time to learn your options better for a secure financial future and choosing trusted advice that will not sabotage your finances can be tricky.

In general, financial literacy is undoubtedly one of the most important knowledge one needs nowadays. It is a key factor for most people in their financial decisions. The financial trends are also changing as time goes by. Company pensions and social security aren’t enough to cover all financial needs in the future. And you can’t rely on the government! You have to take the necessary steps to secure your future.

The need for personal assets to support you in your retirement is greater now than ever!

Hence people are looking in the financial market for growing enough funds for their future. The most common idea that comes to mind about finance is saving and investing.

And yet somehow in the most recent years saving and investing has become a household term for almost everyone. But most do not know the difference or know where to start! Because of lack of knowledge, one becomes gullible and prey to ‘ financial geniuses’, who want to leech off your naivety towards financial matters. This article will cover the initial basic information you need to know.

Investing involves more risk and the potential for greater rewards.

Saving is safer and more guaranteed but usually offers lower returns.

The acknowledgment of the importance of managing finances effectively plays a significant role in changing the lives of so many people. We often watch or hear stories about dreams making them into reality. We have read quotes such as ” It’s not your salary that makes you rich, it’s your spending habits.” The discipline we incorporate with our spending habits gets us the chance to save.

Saving

Saving is the process of putting aside a portion of one’s current income for future use. Saving is setting a risk-free account for your money. It is a key to financial independence and building wealth. It will take time to accumulate large sums. However, if you make it a habit, make it automatic, and stick with it over time, it will happen. Experts say that setting 10-20% of your income and putting it into savings and investments is highly recommended in order to fund your future.

Most people do it to meet a specific future goal like education, emergencies, and or big purchases. And they need the guarantee and safety of their principal.

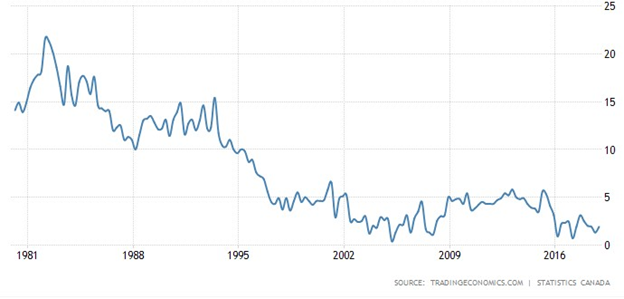

However, the savings rate in Canada has been decreasing since the 1980s. Below is an image showing the typical rate p.a. from 1961 to the present. The line represents the average rate throughout that time.

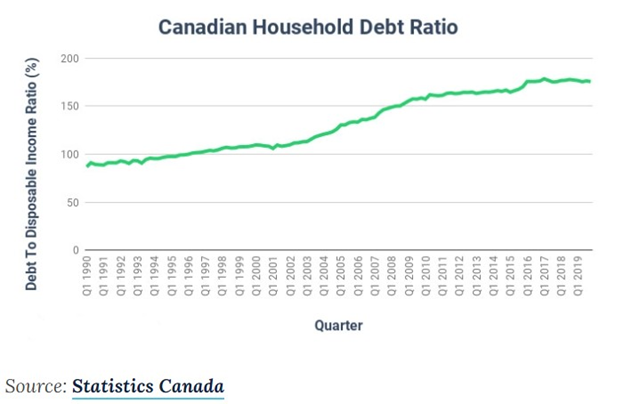

And on the other hand, debt has been rising. As of the 1st quarter of 2020, the Canadian debt to income ratio is about 177%. This means that for every $1 the average household earned, it owed $1.77. The chart below clearly manifests rising credit concerns. It is reflecting a steady increase in household debt.

You might be wondering, why this is happening? One theory is that for most people, borrowing money is easier than having the discipline of regularly setting money aside. Especially with record-breaking lows on interest rates. Plus, it is human nature to prefer instant gratification compared to the pain of having to wait for things.

Investing

It’s the same reason why people save. The only difference is risk and time. One of the most important reasons people invest is to provide funds for a more comfortable life and financially secure retirement. People invest for the long term when their money is utilized wisely to make more money, whether through market returns on a stock, bond, mutual fund, or crypto-currency. It allows you to grow your wealth but also generates an additional income stream. And some understand the power of compounding interest for their finances. However, generally, your money is also locked in for a longer time period, usually 5 years or longer.

Investing isn’t to be sugar-coated with its possible glory. There’s always a risk of losing some or even all of your money if the investment doesn’t perform well. The greater the risk of a loss on an investment, the greater the potential return. The lower the risk of loss, the lower the potential return. Sometimes this isn’t always the case. There are some assets that can provide safe decent returns at lower risk.

You can lower the risk by education and careful analysis, but you cannot eliminate it. In the beginning, it is recommended to seek a professional financial adviser. A financial adviser will help you chart a course for the future you want or you may want to consult one in one of the biggest turning points in your life. You can book a call with us to find out more.

Whether you invest in stocks, bonds, mutual funds, options, futures, precious metals, real estate, small business, or a combination of all of the above, the objective is to generate income or secure a financial future. When investing, three things can impact your profit—taxes, inflation, and risk.

Conclusion

Whether it’s saving or investing, it really depends on your current situation and needs. You need to consider your income, your debt, and your risk tolerance. Everything starts with a budget plan that works for you.

To save or to invest

- The decision is up to your current situation. 10-20% of income is highly recommended.

- If you like low risk and security, save.

- If you like high returns, invest.

- You don’t have enough cash saved to cover three months of living expenses, save.

- You end each month with extra money, invest.

- If you can capitalize and lock in your money for longer-term, invest.

- If you want to have a big purchase like a house or car, save.

Or better yet why not combine both and get the best investment/saving vehicle you can find! Is this even possible – you may ask? Yes!

A combination of the best features of both! The returns of investments with the safety of savings. Also, allow the flexibility of capital access and security of savings. Check the image below.

This particular asset can get you the best of saving and investing. Moreover, it can also perform well despite the uncertainty of the economy. This is the best asset to own!

Take advantage of professional advice now and book a consultation with our trusted financial advisers. They will help you navigate through your concerns and guide you in choosing that perfect vehicle to get you to live your dreams.

To find out more great financial advice from experts, please book a meeting with us.